Having a good credit score is an important part of having a standout rental application, so we talk about credit often at Dwellsy. We’ve discussed how to rent with no credit history, how to build credit, and how to apply for a credit card.

Today, we’re going to explain how you can check your credit for free. We’re also going to suggest a few credit management platforms in case you really want to be on top of your credit game. Before we dive into all of that, let’s get some background information out of the way.

Understanding Credit Scores vs Credit Reports

First, let’s talk about the difference between a credit score and a credit report. Simply put: your credit score is a three-digit number (from 300 to 850) that theoretically reflects your ability to pay back a loan on time. (You can think of your score as a kind of grade.) When you apply to rent a place, your landlord will use your credit score to predict whether you’ll pay rent on time.

Your credit report, on the other hand, is a more detailed record of your credit. It includes your credit score, but it also lists your entire credit history. This means you’ll be able to see every transaction that was used to determine your current credit score, including loans, credit cards, and bank cards.

Your credit score is determined by using your income and the information in your credit report. So your credit score is basically a quick, quantitative summary of your credit history. That’s why landlords and lenders find it useful.

These definitions aren’t the end of the story, however. There are three major credit bureaus in the country, and they’ll all provide you with slightly different scores and reports. Let’s talk about how to understand those.

Understanding Credit Bureaus and How They’re Different

The three major credit bureaus in the United States are Equifax, Experian, and TransUnion. (There are others, but these three dominate the market.) These bureaus hold information about your credit history, as they do for most people in the country. Landlords will request a report from one of these bureaus when you put in a rental application. Each bureau provides a slightly different but generally similar report on your credit.

You might be wondering why these reports differ from bureau to bureau. One reason is that each bureau may have different information about your credit history. Some creditors only report to one or two bureaus––they’re not required to report to all three (or to any). Therefore, it’s possible that not all of the bureaus have your complete credit report. The score they give you is based on the information they have.

All three bureaus will use different algorithms to determine your credit score. The Fair Isaac Corporation (FICO) model is the most popular one out there, and it’s used by the vast majority of lenders. The thing is, there are lots of different versions of this model because FICO is constantly updated. Each lender uses one of these versions of FICO, sometimes combined with their own algorithm, to determine your credit score.

Another popular algorithm is VantageScore, a model developed jointly by the three major credit bureaus. This scoring model is much less popular than FICO, but its popularity is growing, so you’ll see it every now and again. Like FICO, there are different versions because the algorithm updates every now and again. (For instance, the credit management platforms we recommend below all use VantageScore 3.0 rather than FICO.)

It’s a good idea to access all three of your credit reports so that you can understand how they differ. There’s a high chance that the information will differ a little, but not enough to impact you. If there is a big difference between the reports, you’ll want to understand why so that you can explain the difference to landlords, creditors, and anyone else who checks your credit score.

You won’t necessarily know which report your landlord will see, so it’s important to know what all of them look like.

How Your Credit Score is Determined

So what factors determine your credit score? Well, let’s use FICO’s numbers to break things down:

- Payment history––35%: Your payment history makes up the lion’s share of your credit score. Making payments in a timely fashion will impact your score well, and making late payments will impact it badly. This part of your credit score takes public records into account, too––if you’ve filed for bankruptcy, that will have a negative impact on your score.

- Amounts owed––30%: This aspect of your credit history is the second largest one. It takes into account how much you owe in loans. It also compares the balances in your bank accounts to the limits on your credit cards.

- Credit history––15%: The length of your credit history has an impact on your score. If you’ve shown over a long period of time that you’re good at paying back what you owe on time, that will help your score.

- Credit mix––10%: Having a mix of different types of credit accounts and showing that you can manage them well has a positive impact on your credit score.

- New credit––10%: Submitting applications for new loans and opening new accounts will also have some impact on your credit score. If a lender makes a “hard inquiry” on your credit––if they checked it to determine if they would lend to you––then that will negatively affect your score, since you’re taking out a loan. Opening new accounts might have a positive impact because those new accounts will increase the amount of credit you have access to. However, having too many new accounts will negatively affect your score, because as we said, having a long credit history is also important..

What Your Credit Score Means for Your Rental Search

So now that you understand how your credit score is calculated, let’s talk about what that three-digit number actually means. Each of the three credit bureaus will have different labels and different ranges, but this is the general breakdown:

- Excellent: 800 to 850

- Very good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: Below 580

Each lender will be looking for a different range of numbers, so there’s no one magic number that works for everyone. There’s no general minimum in the renting world, either, but it’s helpful to know that the average renter had a credit score of 638 in 2021. In big cities, landlords will be looking for credit scores above 700.

Ways to Find Your Credit Score for Free

So you want to check your credit score. There are plenty of ways you can do that free of charge:

- Annualcreditreport.com: This is the big one. You’re legally entitled to a free credit report every year, and this is where you get it. Even if you go through the credit bureaus sites to try to get reports through them, they’ll direct you back to this site. Because of COVID, you can get a free credit report once a week. It’s unclear as of now when the reports will return to being annual.

- Your bank or card issuer: Your bank or credit card company will probably also offer you a credit score about once a month. Most of the major banks do, including American Express, Capital One, Chase, Citi, and Wells Fargo. Sometimes you have to be a customer/cardholder, and sometimes not; it will depend on the bank.

- Nonprofit credit counseling service: If you’re deeply in debt, you can contact a credit counseling service for help managing your finances. Credit counseling can help you improve your financial situation in a safe, effective way. These services will likely check your credit score when setting you up for assistance. Contact the National Foundation for Credit Counseling for more information.

Free Credit and Financial Management Platforms

If you’d like to manage your credit beyond just being able to see your score and report, you can always use a credit or financial management platform. These will help you understand all of the different aspects of your credit score and what you can do to improve it. Some of these platforms also have other financial management services, so they’ll help you with more than just your credit.

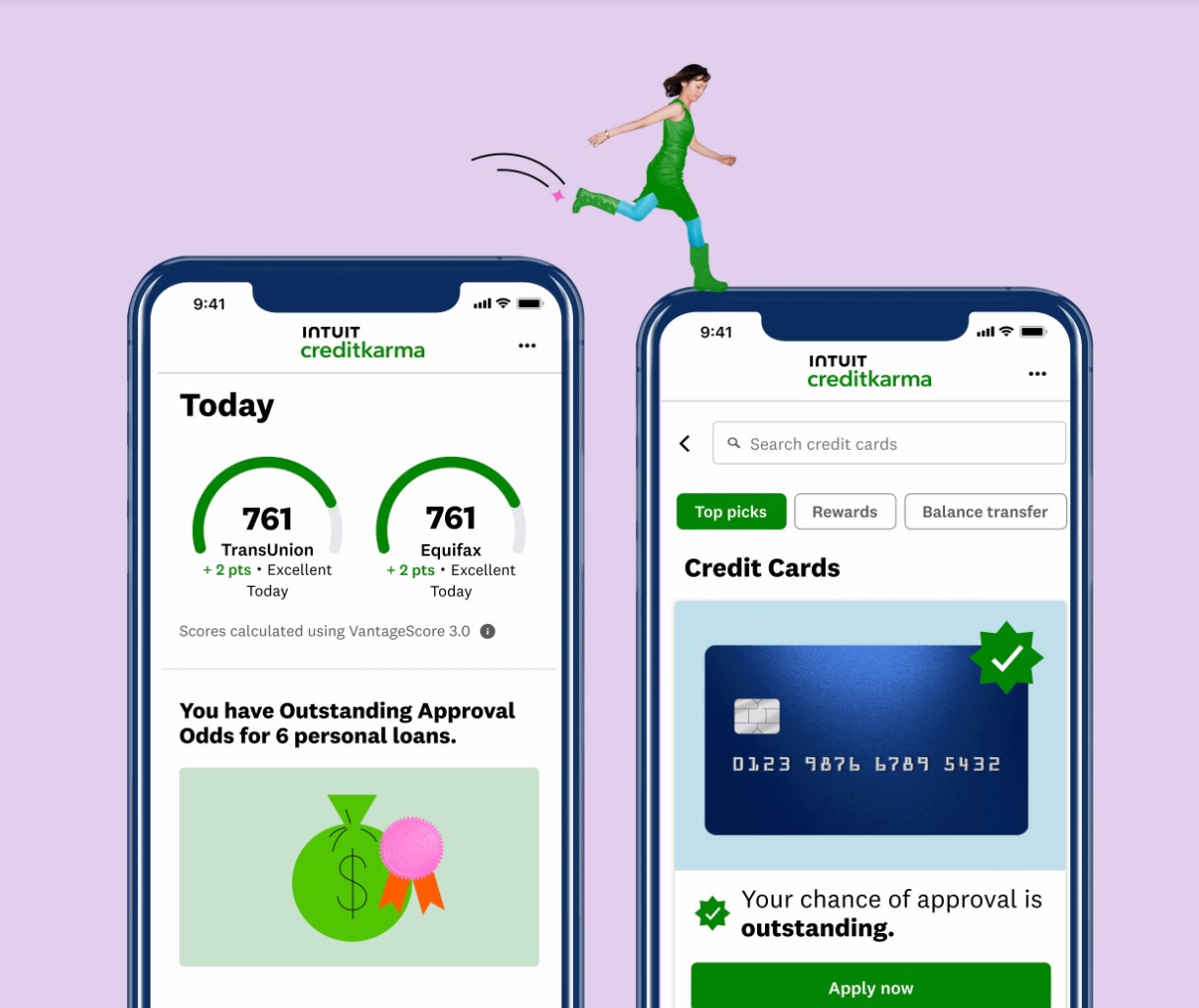

- Credit Karma: Credit Karma is the most credit-focused of all of the platforms we’ve listed here. It pulls your credit score from TransUnion and Equifax, so you’ll get two out of the three major bureaus, and it updates once a week. (Note that this score doesn’t use the FICO model; it uses VantageScore 3.0.) It comes with a host of tools to help you understand the factors that influence your credit score, including a prediction tool that can guess how certain scenarios––like buying a car––will affect your credit score. It’s entirely free, so you never have to give it your credit card info.

- Mint: Mint is a more comprehensive financial management tool than Credit Karma since its services aren’t just focused on credit. It does show you your credit score, which it pulls from Equifax. (Again, this also uses VantageScore 3.0 and not FICO.) Like Credit Karma, it will explain the factors that went into your score. Mint updates your score once a month, so less than Credit Karma’s weekly update. Mint is free, but there’s also a paid version that costs $4.99 a month if you’d like more tools.

- WalletHub: WalletHub is another mostly credit-focused service, but it does have a few other tools that will help you manage your finances more generally. It pulls your credit score from TransUnion. That score is updated once a day, which is more often than any of the other platforms we’ve recommended. (Like the other tools, WalletHub also uses VantageScore 3.0, not FICO.) It will show you your full credit report, too. The platform also has a Credit Analysis feature that explains the different factors impacting your credit score. It will give you a letter grade for each factor so that you can course-correct. Like Credit Karma, WalletHub also has a credit score prediction tool that offers different hypothetical scenarios, but Credit Karma offers more scenarios.

We hope that our credit overview and tool suggestions are useful to you as you manage your credit and your finances more generally. Good luck with your rental search!

Check out Dwellsy’s blog for more articles on credit and renting.

Looking for a rental home? Dwellsy has your back.